What is fractional real estate investing

Real estate investing has traditionally required substantial capital and expertise. However, with the rise of technology and innovative investment models, this landscape is changing. Fractional real estate investing is a revolutionary concept that allows investors to own fractions or shares of high-value properties. In this article, we'll delve into the world of fractional real estate investing and explore its potential benefits.

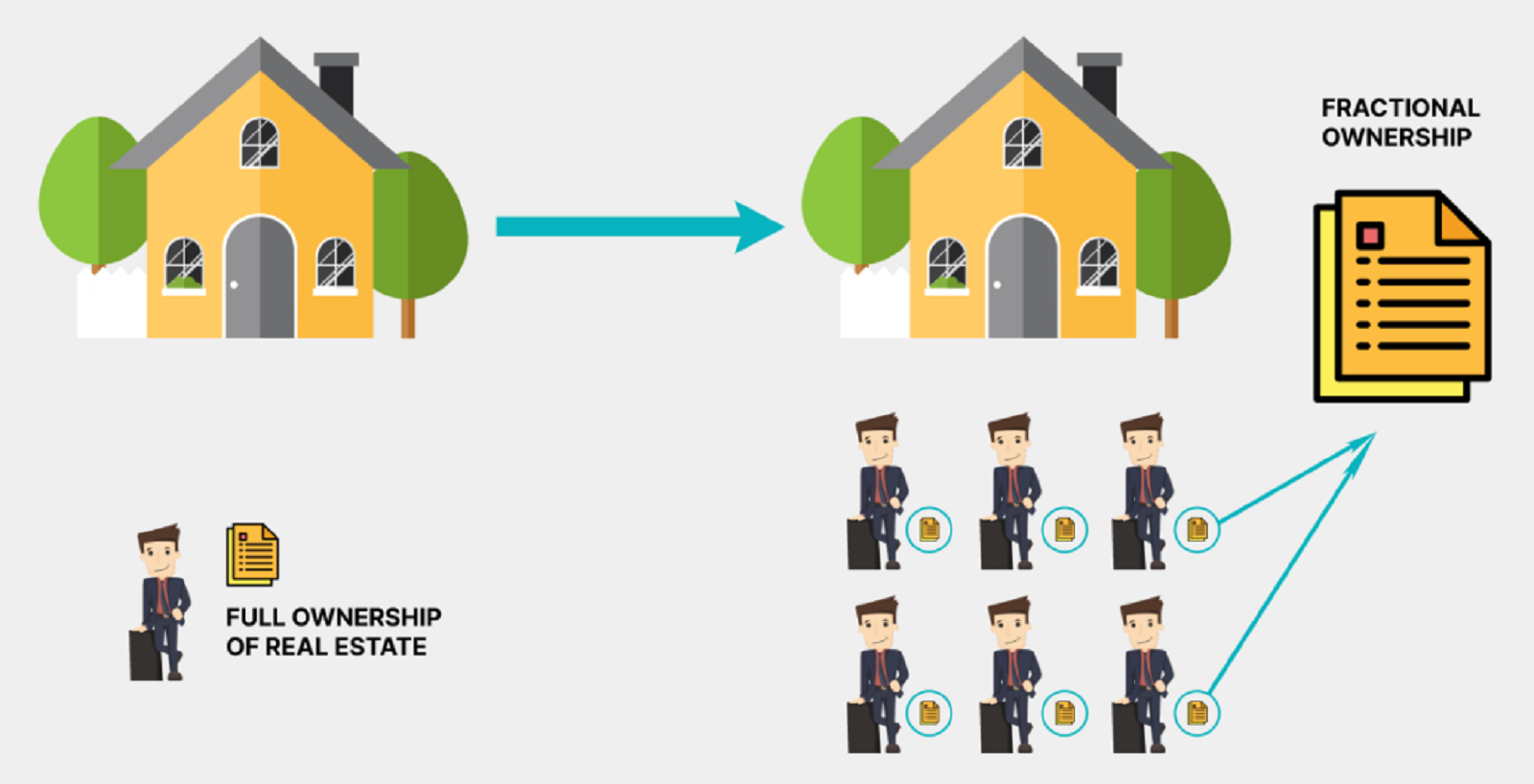

Understanding Fractional Real Estate Investing

Fractional real estate investing involves pooling funds from multiple investors to collectively own shares of a property. This allows investors to access high-quality, income-producing properties that would typically be out of reach for individual investors. Each investor receives a proportional share of the property's income and appreciation, based on their investment amount.

Diversification and Lower Barriers to Entry

One of the most significant advantages of fractional real estate investing is the ability to diversify your investment portfolio. By investing in multiple properties through fractional ownership, you can spread your risk across various markets, locations, and property types. Additionally, fractional ownership reduces the barrier to entry, making real estate investment accessible to a broader range of investors.

Access to Premium Properties

Fractional real estate investing opens doors to high-value properties that may have been unattainable for individual investors. These properties often include luxury homes, commercial buildings, resorts, or vacation properties in prime locations. With fractional ownership, investors can participate in the potential income and appreciation of such premium assets without an overwhelming financial commitment.

Professional Management and Hassle-Free Investing

When investing in fractional real estate, investors can typically rely on professional property management. The responsibility of managing tenants, maintenance, and operations lies with the property management team. This hands-off approach allows investors to enjoy passive income and potential property appreciation without the day-to-day hassles of property ownership.

Flexible Investment Opportunities:

Fractional real estate investing also offers flexibility in the investment duration. Unlike traditional real estate investments, which may require a long-term commitment, fractional ownership often allows investors to have a shorter investment horizon. Some platforms may offer exit opportunities or liquidity options, enabling investors to sell their shares or exit the investment earlier if desired.

Transparency and Technology:

Fractional real estate investment platforms operate using technology, which enhances transparency and simplifies the investment process. Investors can easily track their investments, monitor performance, access property information, and receive updates through user-friendly online dashboards or mobile apps. Technology also streamlines the investment process, making it more efficient and accessible to investors.

Risk and Considerations:

While fractional real estate investing offers numerous benefits, it's essential to consider the associated risks. Like any investment, real estate comes with market risks, such as property value fluctuations and changes in rental demand. Additionally, investors should carefully evaluate the platform and perform due diligence on the properties offered before investing.

Conclusion:

Fractional real estate investing has disrupted traditional real estate investment models, democratizing access to high-value properties and providing greater diversification opportunities. With lower barriers to entry, professional management, flexible investment options, transparency, and technology-driven platforms, this innovative investment approach is an attractive option for modern investors looking to dip their toes into the real estate market.

As with any investment decision, it's advisable to do thorough research, understand the associated risks, and consult with financial advisors to determine if fractional real estate investing aligns with your investment goals and risk tolerance.